How to Meet a Chase Ultimate Rewards Credit Card Bonus without Actual Spend

Chase credit cards are one of the most valuable on the market. Meeting the minimum can very depending on which card can very from $500 - $4,000 in 3 months.

Sometimes we can't spend that much in that short of time or just want our bonus points to hit after the first billing cycle.

A method most points and miles gamers use is manufactured spend. Here is the definition as thepointstraveler.com identifies it:

“Manufactured spending is the process of purchasing something that is the equivalent of cash such as gift cards, money orders, and other items with a miles/points credit card. The goal is to earn miles or points for these purchases and then quickly and easily liquidate the funds and use them to pay back the credit card.”

This is a practice that I have had a lot of experience with. Almost an art. A practice that credit card companies now actively try to combat by inserting this phrase in their terms of agreement. In punishment, they can freeze or claw back your points.

I have a trick for you that does not fall under this category and is significantly easier. Please keep in mind that this is only to be used for the initial sign up bonus and not a way to earn points.

I can confirm that this works with Chase. Try it with whomever. I would like to know your success stories and/or failures if you do attempt.

I don't think this is a crime but if anyone asks... you don't know me and I don't know you. And you can always try to use your credit card to pay for your bail. Maybe you'll hit your bonus that way. So you know...Win- Win...

Lets begin:

Lets use the Chase Sapphire Reserve card as an example. This is the card I used and can verify that it works. Surely this method should work on all Chase Ultimate Reward earning cards.

Step 1:

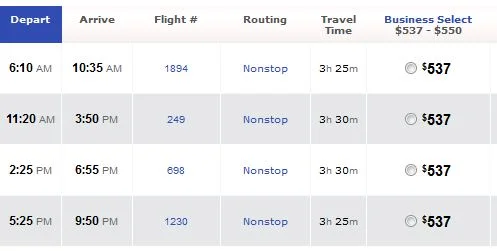

Go to Southwest.com and purchase "Business Select" fares for a flight that is around 4 months out. Purchase as many as you want ( I would change up the routes) until you hit your spend.

These are 100% fully refundable fares (Not Credit)

Here's a route from DAL to LGA for $537.

If you do this 10 days or more out from your billing cycle closing, you will get your bonus points the day the following billing cycle begins.

Step 2:

Wait until your statement posts and see your points in the account. Wait a couple days and cancel the Southwest Flights. I wouldn't recommend canceling multiple flights in one day. Spread them out. Make sure you select the option of returning funds to original payment method.

You'll have 21 days from when the billing cycle closed to receive the refund otherwise you will have to pay interest on the amount you "spent". Do not carry over a balance past 21 days.

Congratulations! You met a credit card bonus without actually having to spend money!

Please only use this strategy if you are on your last month and not sure if you will make the spend requirement naturally.

Or just do what you want because you are a full grown adult and can make your own decisions.